The Plan’s seven investment options offer a variety of asset classes, enabling you to create your own portfolio from a list of specially constructed funds. You may actively choose and monitor your investments or select the UBC FPP Balanced Fund, which offers you a well-diversified portfolio of stocks, bonds, and real assets.

Learn about each UBC FPP investment option:

- Balanced Fund

- Bond Fund

- Canadian Equity Fund

- Foreign Equity Fund

- Fossil Fuel Free Equity and Bond Fund

- Short Term Investment Fund

- Guaranteed Funds

Investment fund sheets updated quarterly

View the Investment Options Matrix for a summary of the Plan’s investment options.

The UBC FPP Balanced fund is the default investment option and was introduced to provide an option for members who do not wish to make their own asset allocation decisions and are seeking satisfactory long-term growth with moderate volatility through diversification across different asset classes. You should also consider whether this fund is appropriate for you based on your risk profile.

We recommend that you review your options carefully and encourage you to seek independent investment advice from an appropriately qualified individual.

Interfund transfers: Short-term trading fee

Please note the following when making changes to your investments:

A 2% fee may be charged when you initiate an interfund transfer into a fund followed by an interfund transfer out of the same fund within 30 days. This is known as short-term trading. Other than the short-term trading fees, there are no fees for buying, selling or switching funds. This fee does not apply to guaranteed investments or the UBC FPP Short Term Investment Fund. For further details, please refer to the Sun Life Short-Term Trading Policy Q&A.

Understanding Your Risk Profile

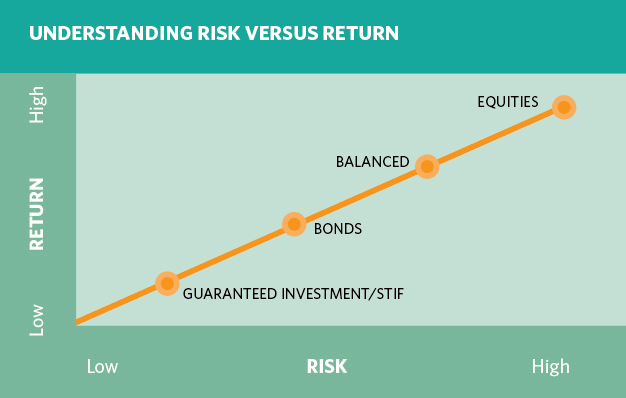

As you are responsible for making investment decisions and understanding how these decisions will affect your account balance and ultimately impact your retirement, it is important to review the concept of risk. Generally, the higher the potential return, the higher the expected risk. There is also no guarantee that you will achieve a higher return by accepting more risk. Higher risk only increases the potential for higher returns. Returns from different asset classes (e.g. bonds, equities) can vary quite significantly in different market environments.

The following chart illustrates the relationship between risk and return.

You should review your investments periodically to ensure your portfolio is aligned with your tolerance to risk, which can change over time.

Diversification

Diversification is one of the key strategies of successful investing. It is the financial equivalent of not putting all your eggs in one basket and is designed to reduce your exposure to investment risk by spreading your investments over a variety of asset classes.

Not all investment move up and down in value at the same time or at the same rate.

Therefore, diversification reduces the overall risk of your asset allocation because the positive performance of some investment offset the negative performance of others.

Environmental, Social, and Governance Factors in the UBC Faculty Pension Plan Funds

The UBC FPP Board has recognized from the inception of the Plan that poor environmental, social, and/or governance (ESG) practices can have an impact on a company’s balance sheet and income statement, and ultimately affect the long-term performance of the investments that our managers make on behalf of our Plan. As a result, the FPP Board believes that the consideration of ESG factors should be part of the investment process documented in the Plan’s Statement of Investment Procedures and Guidelines.

As a part of the ongoing effort in monitoring our investment managers, the FPP Board performs a formal annual review of how all investment managers incorporate ESG Factors in their investment processes.

All of the investment managers currently involved in managing the UBC FPP funds are signatories of the United Nations Principles for Responsible Investment (PRI). The PRI is a global community of signatories committed to sustainable investing and seek to build a more sustainable financial system. Learn more about PRI.

Learn more about how our investment managers are integrating ESG considerations into the Plan’s investments by reading the following reports:

- Brookfield 2024 ESG Report

- BGO 2023 Environmental, Social and Governance Report

- RPIA 2022 Sustainability Report

- PIMCO 2021 ESG Investing Report