The UBC Faculty Pension Plan (FPP) Board of Trustees recently approved two changes to the bond investment manager structure that affect both the UBC FPP Balanced Fund and the UBC FPP Bond Fund options. The following are the changes:

- The Real Return Bonds managed by BlackRock are being sold and these assets will be reinvested in a passive Universe bond mandate with BlackRock.

- State Street Global Advisor’s passive Universe bond mandate has been terminated and these assets will be reinvested in the passive Universe bond mandate with BlackRock.

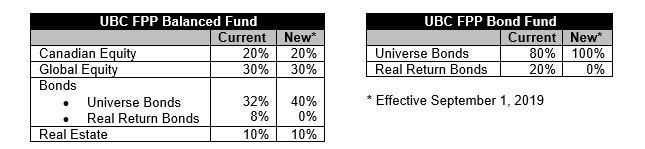

These changes are being made as a result of a recent Asset Mix Review conducted by the UBC FPP Board of Trustees. The objective of the review was to assess whether the Plan’s assets were being invested in the most optimal way. This included assessing a number of different asset classes and various risk and return metrics. The current target asset mix and the new target asset mix for the Balanced and Bond Funds are shown below.

The investment management fees are expected to decrease by less than 1 basis point for the UBC FPP Balanced Fund and 1 basis point for the UBC FPP Bond Fund as a result of these changes, which are expected to be completed by the end of August. For current fee information, sign in to your member account at mysunlife.ca/ubcfpp, then under Investments, select Manage plan > my plan > Plan overview > Account fees.