The UBC Faculty Pension Plan (FPP) Board of Trustees recently approved a change in the asset mix allocation of the FPP Balanced Fund option. This change is a result of our Asset Mix Study in 2019 when it was determined that increasing allocation to real estate and adding new non-domestic real estate mandates would lead to an improvement in the expected risk/return metrics of the fund. The Board conducted an in-depth review of the FPP Balanced Fund’s real estate allocation. As a result of this review, and guided by a desire to manage risk within the Fund, one of the current domestic real estate managers – BCI will be replaced with a global real estate manager and a new U.S. real estate manager will be added.

Two manager searches have been completed and the managers have been chosen. The United States Real Estate manager is CBRE Global Investors (CBRE). The Global Real Estate manager will be named once the documentation has been completed.

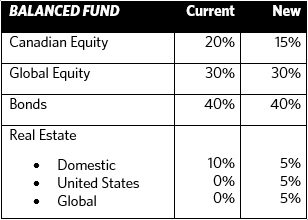

The following table shows the current versus the new fund allocations for the FPP Balanced Fund. The new 5% allocation to real estate will be added by reducing the fund’s Canadian equity exposure.

As soon as the transitions to the new managers have been completed, the investment management fees are expected to increase by approximately 6 basis points for the UBC FPP Balanced Fund. For current fee information, sign in to your member account at mysunlife.ca/ubcfpp , then under Investments, select Manage plan > my plan > Plan overview > Account fees.